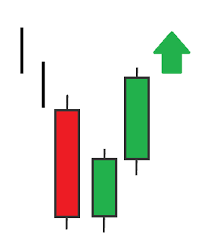

The Three Inside Up is multiple candlestick pattern which is formed after a downtrend indicating bullish reversal.

It consists of three candlesticks, the first being a long bearish candle, the second candlestick being a small bullish candle which should be in the range the first candlestick.

The third candlestick should be a long bullish candlestick confirming the bullish reversal.

The relationship between the first and second candlestick should be of the bullish harami candlestick pattern.

Traders can take a long position after the completion of this candlestick pattern.

What Traders Interpret From a Three Inside Up Pattern

The downtrend appears to continue on the first candle, with a very large sell-off creating new lows. This typically makes sellers more confident while discouraging new buyers. The downtrend of the first candle creates a large sell-off while posting new lows. Within the prior candle’s trading boundary, the second candle will open.

Instead of following through with the downside, it closes higher than the current open but remains within the boundaries of the first candle. This usually raises a red flag that short-term sellers could see an opportunity to exit. Finally, the third candle completes the overall bullish reversal. It traps any remaining short sellers while also attracting new ones who wish to establish a long position.

Significance of three inside up candle pattern

– One need not trade when they see the three inside up candlestick. It can simply be used as a way of alerting sellers that the short-term price may be changing its direction.

– For any people who don’t wish to trade through this candlestick pattern, a long position can be taken by the end of the day on the third candle. It could also be taken on the following open for a bullish three inside up.

– Additionally, a stop loss can be placed right below the close of any of the three candles. Which candle is chosen to place the stop loss will depend upon the risk appetite of the trader.

– The three inside up candle pattern does not show profit targets. Hence, it’s wise to make use of another form of technical analysis to decide when to take any profits should they develop. One could use the strategy of exiting at a pre-decided reward/risk ratio as well as employ a trailing stop loss, to determine their exit.

– Important to keep in mind that the three inside-up candlesticks is fairly common. Hence, it is not always a reliable measure. As it is short-term in nature, it could bring out only a small to medium scale move in a new direction. The directional change might not always be significant with the price potentially reversing its direction again, back in the direction of the original trend.

By trading in the same direction as the longer-term trend, one may see an improvement in the performance of this pattern. Trading in the same direction as the long-term trend may help improve the performance of the pattern. During an overall uptrend try looking for the three inside-up candlestick patterns during a pullback.

By ~ Capital Varsity