A market order instructs the buyer or seller to buy or sell at the best available price. The final execution price may differ from the price that was given when the order was placed. For more information, please see the section about slippage.

Example 1:

When the buy and sell market prices for the EUR/USD are 1.08050 and 1.08060, respectively. If you wish to buy EUR/USD, you can place an order at the Current Market Price of 1.08060, and the transaction will be executed at the next available price.

Example 2:

When the buy and sell market prices for the EUR/USD are 1.08050 and 1.08060, respectively. If you want to sell EUR/USD, you can place an order at the quoted market price of 1.08050, and the transaction will be completed at the next available price.

One-Click orders are available in our trading system. You can instantly initiate, close, hedge, or close all trades for the same currency by just clicking on the prices presented on the screen. You will not miss any trade opportunities this way.

One-Click Order with Stop Loss

You can set a stop-loss point distance with One-Click order. If you set 15 pips, for example. When you “click” to buy the EUR/USD at 1.08060 and it is successfully executed, a stop-loss order at 1.07910 is instantly generated.

One-Click Order with hedging

With a One-Click order, you can activate hedging. When this function is activated, for example, if you have a buy position in EUR/USD, selecting the sell button will not end the existing buy position; instead, the system will establish a new position to sell EUR/USD at the next available price, resulting in a hedging (locked) position. (Please use the hedging function with caution, if you do not understand this function, please leave this function disabled.)

Please read the One-Click Order User Guide for more details.

A limit order is a Buy/Sell Order that you place at a specific price. The execution price is the order price that has been set in advance. You can choose a price lower than the current market price when placing a buy order. If you wish to sell something, you can select a price that is higher than the current market price. Only when the market hits the price you set will the limit order be executed. A limit order can be used to open or close a position. Please check our slippage policy for information on price change that is positive or negative.

Example 1:

The EUR/USD sell and buy market prices are 1.08050 and 1.08060 respectively. If you want to open a position to buy EUR/USD, you can set a limit order lower than the current market price 1.08060 (for example, 1.08030). When the buying market price drops to 1.08030, the transaction will be executed.

Example 2:

The EUR/USD sell and buy market prices are 1.08050 and 1.08060 respectively. If you want to open a position to sell EUR/USD, you can set a limit order that is higher than the current market price 1.08050 (e.g. 1.08080). When the selling market price rises to 1.08080, the transaction will be executed.

Example 3: (Taking profit)

If you have a EUR/USD long position, and the current sell and buy market prices are 1.08050 and 1.08060 respectively, you may place a close limit order above the current selling market price 1.08050 (e.g. 1.08080) as a profit taking order. If the sell market price rises to 1.08080, the transaction will be executed.

A stop order can be used as a stop loss in most cases. It’s used to protect yourself from more losses if the price moves against you. When the market price hits a certain level, a stop order is triggered (see example 2). In some cases, experienced traders may use a stop order to open a position by placing a purchase order above the market price or a sell order below the market price. (See example 1).

Example 1:

The EUR/USD sell and buy market prices are 1.08050 and 1.08060, respectively. If you want to open a position to buy EUR/USD, you can set a stop price higher than the current market price of 1.08060 (for example, 1.08090) to place an order. If the buying market price rises to 1.08090, it will be triggered, and the transaction will be executed at the next available price.

Example 2: (used as a stop loss)

When you hold a long position (buy) in EUR/USD and the current sell and buy market prices are 1.08050 and 1.08060 respectively. If you want to limit the loss, you can place a stop order with a price lower than the current market price of 1.08050 (for example, 1.08020) to close your position. If the selling market price drops to 1.08020, it will be triggered and the transaction will be executed at the next available price.

The client can place two orders at once using an OCO order. It combines a limit and a stop order, but only one can be implemented at a time.

To put it another way, as soon as one of the orders is half or filled, the remaining order is automatically cancelled.

Note that cancelling one of the orders will also cancel the other one.

An order containing two stages, when the first stage (open position) order is filled, the second stage (close position) order will take effect. Such order for both stages can be either limit order or stop order.

An IFD-OCO is a combination of an IFD and an OCO order.

The entry order of limit or stop, along with taking profit and stop-loss orders, will be placed simultaneously. The closing order (i.e. take profit and stop loss) will remain dormant until the entry order has been executed.

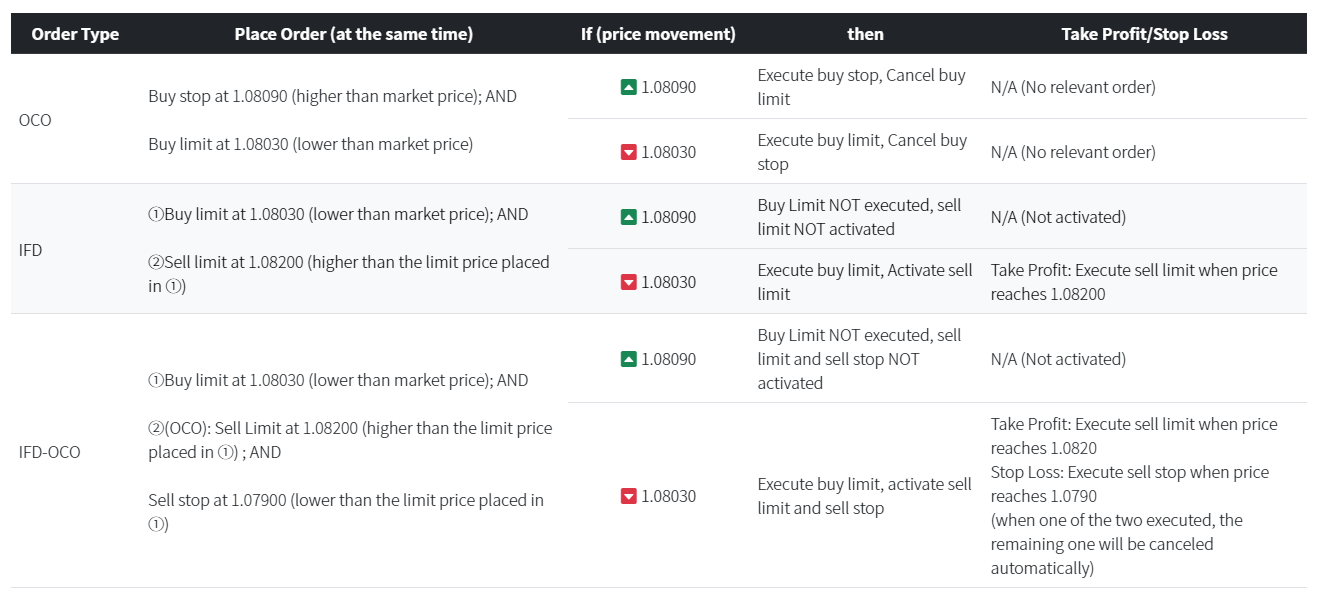

Examples of IFD, OCO, and IFD-OCO:

The EUR/USD sell and buy market prices are 1.08050 and 1.08060

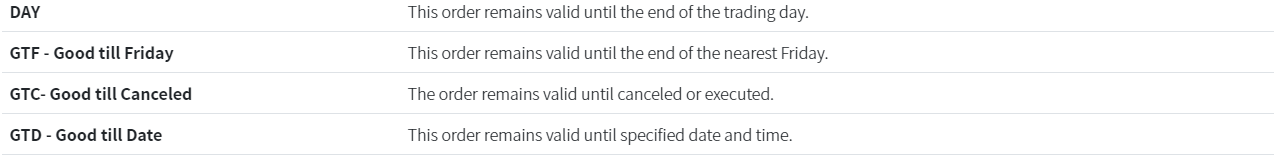

Limit and stop orders are not executed immediately. When placing such orders, you may choose the expiration period for your order. Below are the types of expiry.

Slippage in Forex trading refers to the difference between the projected price at the time the trade was placed and the actual price at which the trade was completed.

It’s a typical occurrence in the Forex market. Slippage can be either positive (Positive Price Movement) or negative (unfavorable price movement).

Due to the rapid rate of price movements, slippage may occur as a result of the time it takes to place an order and the time it takes to execute it.

A delay in execution can arise for a variety of reasons, including internet connection issues, a lack of available liquidity, or when placing big orders.

Slippage can also happen during times of strong volatility, perhaps as a result of a news event that makes it hard to execute trade orders at the expected price because the market has moved far away from it. Only at the next available price may the order be fulfilled.

Using the slippage setting option on our trading system is one approach to reducing the risk associated with slippage.

No Slippage∶ The next available buy price is 1.22000 which is the same as the order price.

Positive Slippage – Favorable Price Movement∶ The order is completed at 1.21900 since that is the next available buy price. There is positive slippage since the execution price is 10 pips lower than the order price.

Negative Slippage – Unfavorable Price Movement: The order is completed at 1.22100 since that is the next available buy price. There is negative slippage since the execution price is 10 pips greater than the order price.

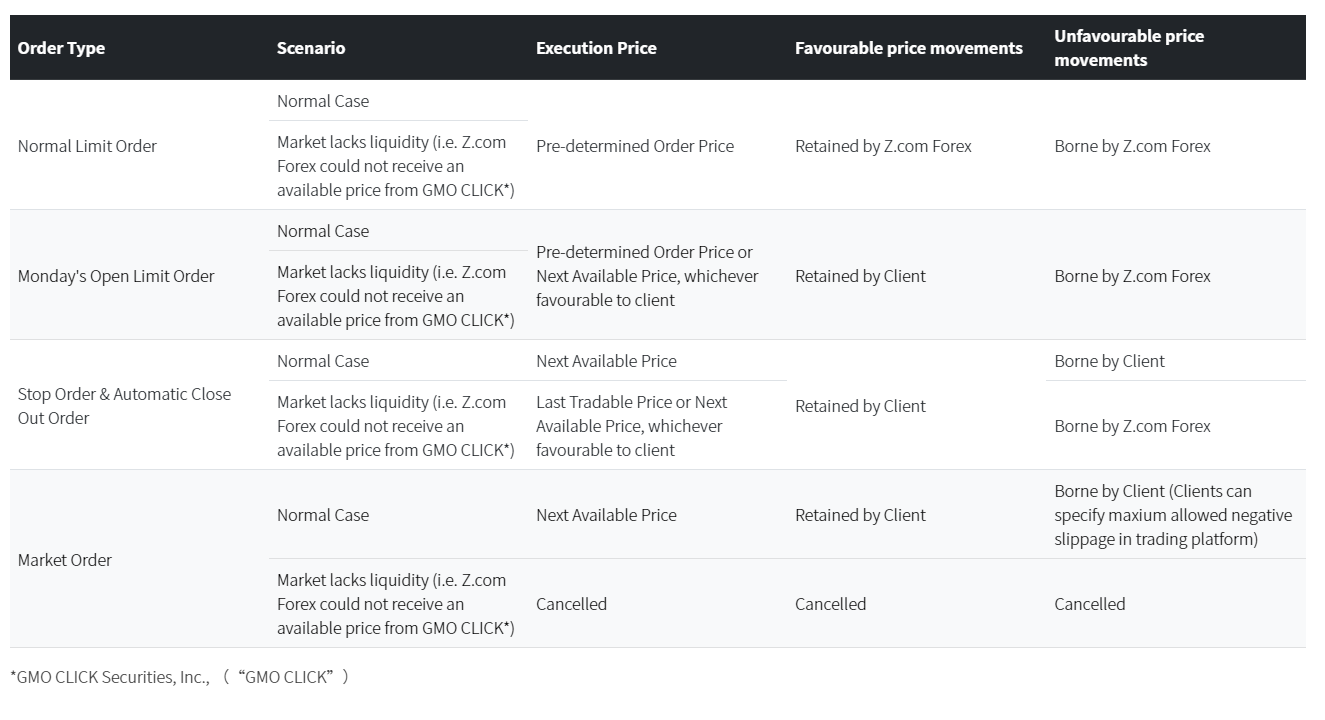

Please note that slippage policy is various in different kinds of order types. Kindly refer to the following table:

Slippage Setting

Please enter [Trade] tab after login to our trading platform, then click the user preference icon and edit the maximum slippage pips. Untick the [No Restriction] box and enter the maximum slippage allowed in pips.

In another way, clients can also edit the Maximum Slippage Pips allowed in order panel, and check the [ON] box to activate the function.

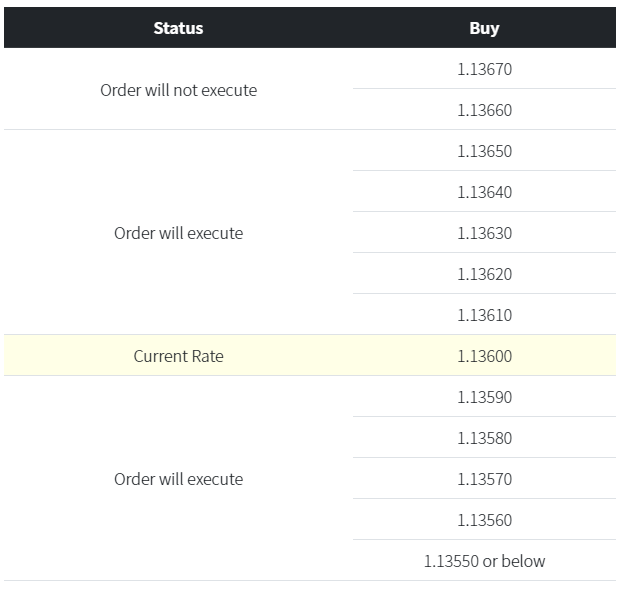

For example, the Maximum Slippage Pips allowed is 5 pips, and the rate of EUR/USD ask price is 1.13600. The order will be executed below 1.13650. (Please refer to the table below)