Bullish Reversal candlestick patterns indicate that the ongoing downtrend is going to reverse to an uptrend.

Thus, the traders should be cautious about their short positions when the bullish reversal candlestick chart patterns are formed.

Below are the different types of bullish reversal candlestick patterns:

- Hammer:

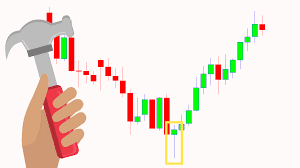

Hammer is a single candlestick pattern that is formed at the end of a downtrend and signals a bullish reversal.

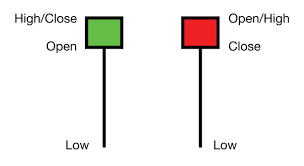

The real body of this candle is small and is located at the top with a lower shadow which should be more than twice the real body. This candlestick chart pattern has no or little upper shadow.

The psychology behind this candle formation is that the prices opened, and sellers pushed down the prices.

Suddenly the buyers came into the market and pushed the prices up and closed the trading session more than the opening price.

This resulted in the formation of bullish pattern and signifies that buyers are back in the market and downtrend may end.

Traders can enter a long position if next day a bullish candle is formed and can place a stop-loss at the low of Hammer.

Below is an example of Hammer candlestick pattern:

By ~ Capital Varsity