Vanilla choices have a lot of variety, which is what makes them so powerful. They enable traders to adapt or alter their positions in the financial markets in response to changing market conditions.

Binary Options offer the advantage of lowering the emotional component of trading while still being simple to comprehend. They can, however, appear to be nothing more than straightforward, extremely speculative wagers.

Options are sophisticated derivative instruments with a high risk of loss. Some options trading techniques are prudent, while others are speculative.

Most multinationals and trade experts utilize options in some form or another, whether to hedge Foreign Exchange Risks or to speculate.

The basic ideas of binary and vanilla options trading are presented in the following sections. Keep in mind that most options traders have a lot of experience, so you won’t be able to become an expert only by reading these articles.

Binary options are well-known for being simple to use. The trader bets on the ending price of a currency pair or a stock at the end of a predefined period.

Although binary options are simple to use, they are not suitable for novice traders; they are better suited to individuals with some trading expertise.

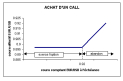

The conventional “call and put” options are discussed in this article. They’re also known as vanilla options, and they’ve been there since 1973 on major exchanges.

Warrants and call options are securities that give their owners the right, but not the duty, to buy a specific number of shares at a specific price over a set period. What are the distinctions between these two trading platforms?

The quarterly expiration days of four derivative products: options on indices, stock options, futures on indices, and stock futures, are known as quadruple witching days.

On the third Friday of each month, some choices expire (these are known as Triple witching Fridays). Fridays are notoriously turbulent, particularly near the conclusion of the quarter (Quadruple witching days).