DISCIPLINE: To avoid making rash decisions, create a trading plan and define some goals before you trade. Even if you’re losing, pay attention to the signs your plan sends out. You should have faith in your system if it has performed well in demo mode.

HUMBLENESS: When dealing with the markets, you must accept the trends you observe as well as the knowledge that you will not always be correct. Examine your blunders with a critical mind.

KEEPING COOL: You must always maintain a level head and separate trading from the rest of your life. You must release any tension you may be experiencing and remain objective when it comes to the markets. Don’t let trading consume your personal life, and don’t succumb to your ego. You’ll have to close a losing trade sooner or later; don’t try to avenge yourself on the market by instantly initiating another position.

Behavioral finance aims to understand what motivates investors to make irrational decisions by combining behavioral and cognitive psychological theories with traditional economics and finance.

It’s easier said than done to stick to a trading strategy without breaking any regulations. Here are some of the reasons why most traders struggle to keep to their trading strategy.

The subsystem of your trading plan that regulates how you follow your trading strategy and risk management system is your emotion management system.

Two traders may view a chart differently, with different outcomes. A lack of self-control is the primary cause. Some people take on too many risks, which has a significant impact on their perceptions of the market and what it might do next.

The Myers-Briggs personality types of traders (MBTI).

Mindfulness is a mental skill that traders who want to improve their trading mentality might benefit from.

To make money in the forex market, you need more than just a strong technique. When two traders utilize the same trading method, their outcomes are generally different or opposing. This disparity is attributable to trader psychology, as each trader has a unique way of thinking.

The mentality of the forex trader is a crucial factor that should not be overlooked. A trader must first determine his or her essential personality qualities to develop a trading style that corresponds to his or her attitude.

During successful streaks in forex trading, one’s imagination and willingness to take risks increase. When your hard effort and time invested result in losses rather than gains, this is usually not the case. Following a run of losing Forex deals, stress and the taking of needless risks are common adverse effects.

Even the best trading techniques, systems, and procedures look fantastic on paper, but when it comes to investing in the real world, market turmoil and unpredictability make even the best trading strategies unsuitable.

Why do smart traders make mistakes like clinging on to losing positions and decreasing earnings by exiting deals too soon? Trading plans often vanish in a fog of anxiety and doubt due to the emotional impact of the possibility of losing money.

Maintaining impartiality while trading is one of the most difficult tasks you’ll encounter in your quest to become a successful forex trader. While numerous things can contribute to your loss of objectivity in a specific situation, there is a clear and defined way to regain it.

Most newcomers who transition from a demo to a genuine account believe that their demo results can be simply repeated on a real account. As a result, when traders find that this is not always the case, they give up. The following are some of the reasons.

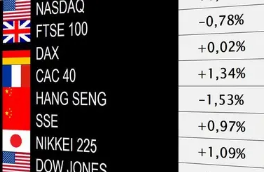

This diagram depicts all of the psychological reactions that a trader or investor may have when watching market movements. We’ve all been there, as embarrassing as it is to acknowledge!