The “buy and hold” strategy is for investors who choose to take a long-term approach to invest. They conduct basic research on a company’s past and current profits, assess the industry’s future, and read expert reviews on the stock. The idea is to select and invest in High-Quality Equities that will pay a long-term dividend or return. As a result, the investor who buys and retains stocks is less worried about price fluctuations daily.

The short-term speculator, or trader, is more concerned with intraday or daily price movements in a stock. He frequently employs a more technical approach, examining charts and statistics to get a sense of where the stock is headed. To generate a rapid profit, the idea is to buy cheap and sell for more. He can also engage in a stock “short sale,” which permits him to sell a stock that he does not own. When a trader feels that the price of a stock will fall, he will utilize this approach to profit from a falling market. If the stock’s value rises in the market, short-selling it can result in an endless theoretical risk.

These are only two examples of how stocks can be utilized as a long-term investment or a short-term speculative instrument. It should only be based on your objectives and risk tolerance that you decide how to trade stocks.

A series of articles on stock market trading is provided below to assist you in learning the fundamentals of stock investment.

Choosing a stockbroker is trickier than it appears. The correct stockbroker can expand your investment alternatives, while the wrong one can limit your options and increase your costs.

The protection of stock market investors from the insolvency of their stockbroker, as well as compensation schemes in various nations.

Initial public offers (IPOs) on the primary market, secondary market transactions, private placements, and repurchases of a listed company’s shares are all examples of secondary market transactions.

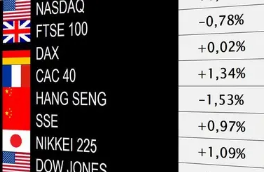

A stock index, often known as an index fund, is a group of individual stocks that investors can use to track the health of a market or sector.

A basic understanding of how the stock market works can be extremely beneficial. So, here’s a quick primer on how to get started investing in the stock market.

The market capitalization of a company’s stock can be a valuable tool for determining the risk of investing in its stock.

A dividend is a percentage of a company’s profits that it distributes to its shareholders. The yield is determined by dividing the dividend amount by the stock price.

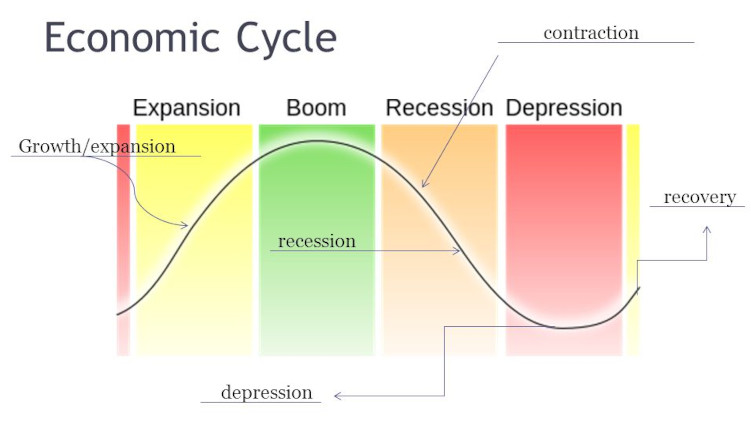

Stock market crashes are merely a blip on the radar of the world’s stock markets’ lengthy rising trend. They might also be associated with excellent purchasing opportunities for traders.

The New York Stock Exchange has an average of 254 trading days per year and is the world’s largest stock exchange in terms of total trading volume.

Learn how to use the stock exchange to trade equities. An overview for traders and investors interested in learning more about the online stock market.

You can speculate on the performance of stock markets or an entire industry by trading index CFDs.

The first step in determining whether you should invest in active or passive stocks is to analyze your risk tolerance.

A basic stock analysis aids in the identification of the most promising investment prospects. To assist you in analyzing a stock, below are four metrics of a company’s valuation.

How to choose the best stocks in the market for day trading strategies.

Here’s a summary of the most common types of stock investments: Blue Chip stocks, tech stocks, cyclical stocks, speculative stocks, and defensive stocks.

Unlike cyclical equities, which are associated with economic cycles, defensive stocks are safe-haven assets that are unaffected by economic conditions.

Market declines are good news for experienced traders and investors. When the stock market is down, keep these six points in mind.

Whether you trade individual stocks, stock market indexes, gold, or other investments, you may utilize risk management methods to mitigate potential losses.