– Inside bars

– Pin bars (dojis)

– False signals

Skilled traders use support and resistance levels as part of their technical analysis. Here are a few instances of how you can use trendlines and a forex trading strategy of support and resistance.

This forex trading strategy is based on price action. It will show you how to use two alternative timeframes to determine the direction of a trend. Trading trends in a short timeframe is possible.

A pin bar is a three-bar trend reversal in the form of a pin bar. “Pin Bar” is an acronym for “Pinocchio Bar.”

False breaks reveal what institutional traders are up to:

small retail traders’ stop-loss thresholds to pull them out of their positions and create a pricing “vacuum” to reverse the market’s trend.

Identifying good from bad trading signals is an issue that many traders face. Here’s how to filter trading signals based on price action.

The inside bar and NR4/IB trading tactics allow you to detect a significant likelihood of an extremely turbulent movement following a formation’s breakout.

Traders need to understand that trading outcomes follow a random distribution.

Setting your take-profit and stop-loss settings is critical for maximizing profits and minimizing losses when trading.

This is a simple scalping method that tries to profit quickly from the day’s peak or low. The entry rules are straightforward.

Price Action Setups

– Inside bars

– Pin bars (dojis)

– False signals

One of the founding pioneers of technical analysis is Charles Henry Dow. He co-founded the Wall Street Journal with Edward D. Jones. He invented the Dow Jones index, the world’s oldest stock market index, to protect the economy’s future progress. Even though the financial markets have evolved significantly, Charles Dow’s theory remains applicable today.

Tom Williams later improved on Richard Demille Wyckoff’s method of comparing prices in proportion to volume. VSA is an analytical technique based on experienced traders’ trades that reveals why and when they position themselves in the markets.

At the end of the 1930s, Ralph Nelson Elliott (1871-1948) published the “Wave Principle”, having been inspired by Dow’s theory and Italian mathematician Fibonacci’s golden number. Elliott believes that the markets don’t evolve randomly, but instead follow repeated trend cycles (up or down) that are influenced by nature and human behavior.

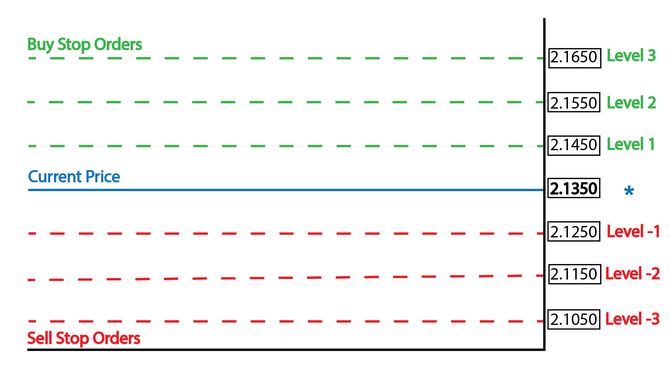

Grid Trading is a trading strategy that enables traders to enter the market and make a profit regardless of the market’s trend.

This forex trading strategy is effective because it allows you to profit regardless of market direction. Even if the market reverses directions, your hedge will protect you (and create money!) by detecting trending markets.

When implemented during periods of low volatility, the round-number forex trading method allows regular non-professional traders to gain an advantage over specialists (banks and market makers).

Correlations can be utilized to avoid disastrous trades such as a false break, as well as to corroborate a trade or an analysis. The objective is to examine if currency pairs with a positive correlation are moving in the same direction as the one you’re interested in.

The dollar smile theory, as described by Stephen Jen, a former currency strategist and economist at Morgan Stanley, allows traders to predict long-term forex trends.

The Commitment of Traders approach is predicated on major institutional traders disclosing their long and short holdings in a weekly report. It is beneficial since it aids in determining when a market reversal is imminent.

The NFP (non-farm payroll) is a key economic indicator that causes a lot of volatility in the currency market. Traders must be wary since professionals (market makers) influence the market to find their customer’s stops during these announcements.

Simulator programme for FX trading. It allows you to develop and test trading strategies based on technical analysis utilizing historical data spanning years. This is an excellent tool for establishing a trading strategy quickly and effectively. Advanced users can develop their signs and procedures thanks to open interfaces.