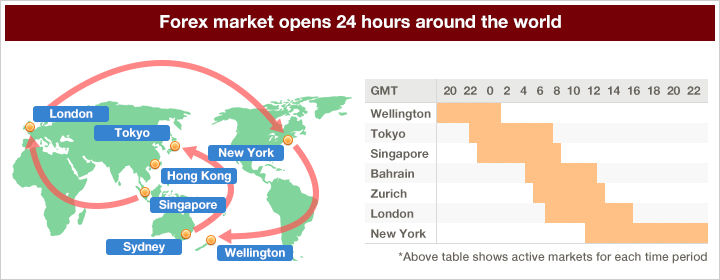

24 HOURS A DAY

The Foreign Currency Market operates across multiple time zones, with main trading periods overlapping one another, allowing traders to trade at any time.

Each Forex Trading Day begins with the opening of Wellington, followed by Sydney and other Asian markets such as Tokyo and Hong Kong, London and other European markets, and finally New York in the Americas.

Forex trading operates 24 hours a day. You can trade anytime and anywhere with access to the internet through any internet-enabled device, be it your home computer or smartphone.

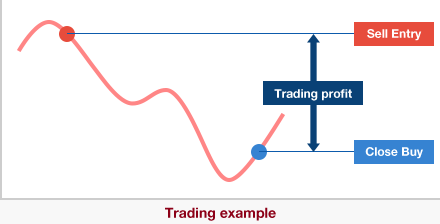

GO LONG OR SHORT

With FX, you can purchase (long) or sell (short) a currency pair using FX. There is a chance for you to benefit no matter which way the market is heading.

As an example, consider the USD/JPY Currency Pair: If you believe USD/JPY will fall in value, you can benefit by selling it and then buying it back at a cheaper cost, or vice versa. This is how simple it is to enter and exit transactions based on simple market speculation at any moment.

DAILY INCOME PROFITS

Rollover is the interest earned or deducted for holding a position open overnight. Rollovers are calculated and applied on each trading day.

You will earn a rollover for the trading day if the interest rate on the currency you bought is higher than the interest rate on the currency you sold.

Click here to find out more about rollovers.

MAXIMISE RETURNS WITH LEVERAGE

You must maintain the required margin, which is a pre-determined percentage of the contract value, to place an FX trade. You can trade at greater positions than your actual invested amount with significant leverage to enhance your returns.

Leverage is a two-edged sword that carries a larger risk of losing money while also allowing for better profits.