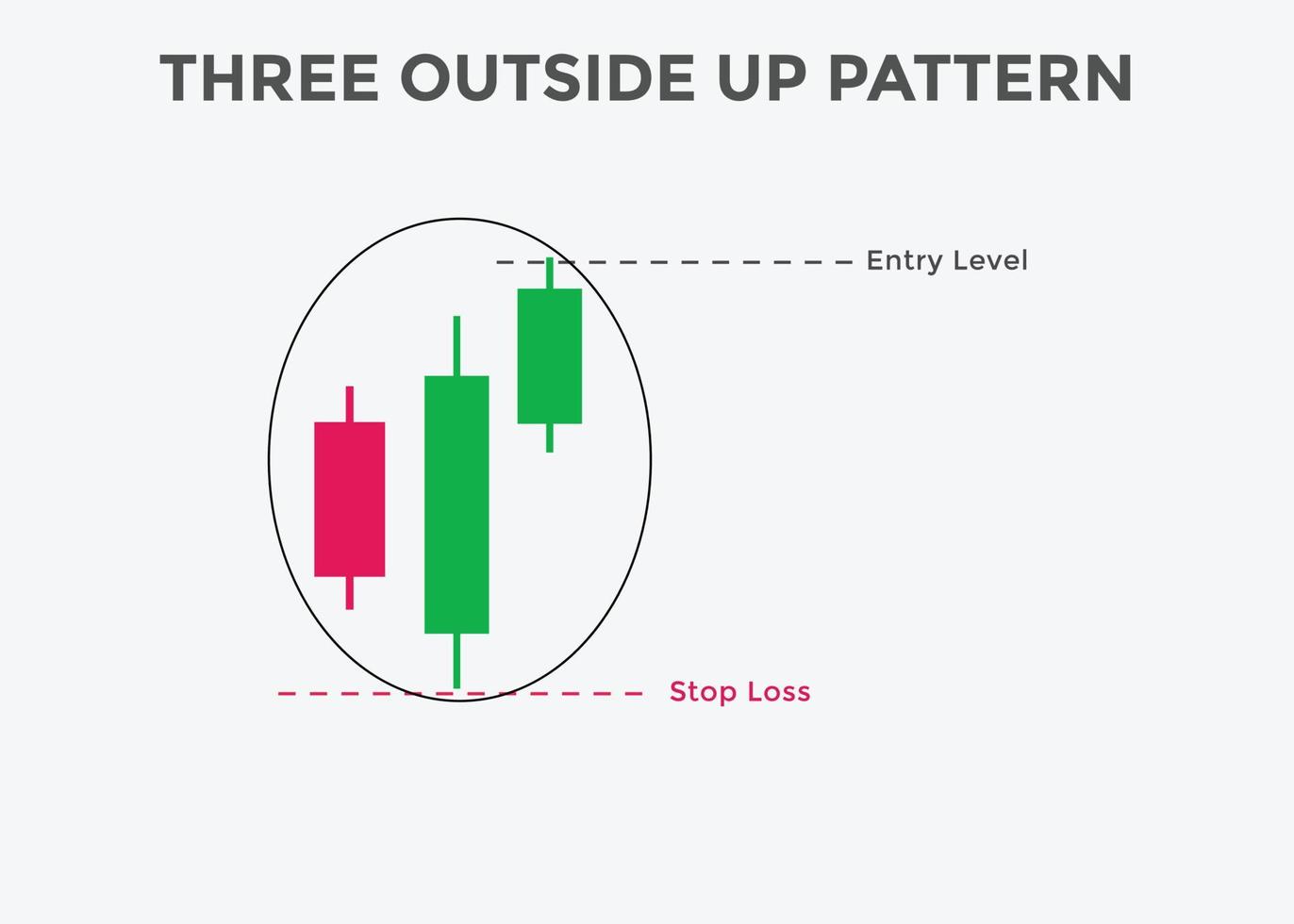

The Three Outside Up is multiple candlestick pattern which is formed after a downtrend indicating bullish reversal.

It consists of three candlesticks, the first being a short bearish candle, the second candlestick being a large bullish candle which should cover the first candlestick.

The third candlestick should be a long bullish candlestick confirming the bullish reversal.The relationship of the first and second candlestick chart should be of the Bullish Engulfing candlestick pattern.

Traders can take a long position after the completion of this candlestick pattern.

Construction:

First candle

a candle in a downtrend

black body

Second candle

white body

candle’s body engulfs the prior (black) candle’s body

Third candle

closing price above the previous closing price

white body

The Three Outside Up pattern is a three-line pattern being an extension of the two-line Bullish Engulfing pattern. The pattern was introduced by Morris, and his intention was to improve the two-line pattern performance. The third candle is meant to behave as a confirmation of the Bullish Engulfing. As with the Bullish Engulfing, the first black candle is engulfed by the second one with a white body.

The first line can appear as a short or long line. It can be any basic candle having black body. Doji candles are allowed except the Four-Price Doji.

The second line has to appear as a long line, and the candle needs to be of white color. It can be one of the following candles: White Candle, Long White Candle, White Marubozu, Opening White Marubozu and Closing White Marubozu. Spinning tops and doji candles are not allowed.

The last candle line can be any basic candle, which has a white body and closes above the second candle’s closing price.

In the case of this pattern, shadows length do not matter.

Although the idea behind the Three Outside Up is to confirm the Bullish Engulfing, in our opinion the extended pattern should be confirmed nevertheless. Confirmation can be in the form of breaking out of the nearest resistance zone or a trendline.

The three outside up pattern has a strong bullish implication as it forms after an extended downward price movement. It is seen as a reliable reversal setup, and most smart traders add it to their trading arsenal. The formation indicates a buying opportunity in the market, which can be traded alone or when supported by another analysis.

This pattern is formed during a long downswing. This is how it occurs: The market has been falling for a while and suddenly comes to a halt with the appearance of a bullish engulfing candlestick, indicating a potential bullish reversal. But prior to the engulfing bullish candlestick, the last bearish candlestick in the downswing is not as big as the other bearish candlesticks before it, which is an early indication that the downswing has lost momentum.

This last bearish candlestick is considered the first candlestick in the pattern. The fact that the second candlestick opens below its closing price before turning to move steadily upward during the trading session and ending with a closing price that is well above the first candlestick’s open price shows that the downswing would have continued but buyers stepped up their game and shifted the momentum to their side. What you have is a long bullish candlestick that is pointing to a possible reversal.

Finally, the third trading session confirms the reversal suggested by the first two sessions when it closed as a bullish candlestick, with its closing price higher than that of the second trading session. Since this pattern occurs in a downswing, it strongly indicates a possible upward reversal in the price direction.

As a matter of fact, many traders consider the pattern a reliable trade signal on its own. Even if the bullish engulfing candlestick in the second session is seen as a fluke, the third session closing higher than the second session shows that the price is actually determined to head upward. The pattern is more significant if it happens at a known support level — it means that a rebound has occurred.

By ~ Capital varsity