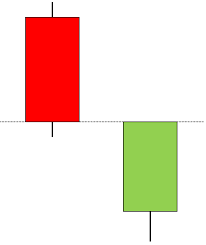

The on neck pattern occurs after a downtrend when a long real bodied bearish candle is followed by a smaller real bodied bullish candle which gaps down on the open but then closes near the prior candle’s close.

The bears are in control of the market, and they continue their dominance with the On Neck pattern.

The first candle is bearish, continuing the downward trend, and although the next candle is bullish, it opens and closes beneath the first candle.

This movement suggests a continuation of the downtrend, so it is recommended that you continue to ride the trend.

The pattern is called a neckline because the two closing prices are the same or almost the same across the two candles, forming a horizontal neckline.

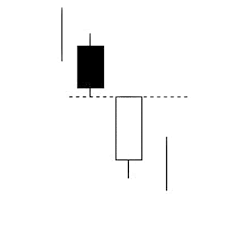

To identify the On Neck pattern, look for the following criteria:

- A downtrend must be in progress.

- A tall black (bearish) candle must appear.

- A smaller white (bullish) candle must follow the black candle.

- The close of the white candle should nearly match the prior candle’s low. It should not rise higher than the black candle’s low price.

- To confirm the On Neck pattern, look for a black candle on the third day, continuing the downward trend. A long body shows strength, as does a gap between the second and third days.

Trading with On-Neck Candlestick Pattern

The security is in a primary downtrend or a significant correction inside a primary uptrend. A long black genuine body is displayed by the first candle. Bearish complacency grows due to the weak market action, while weakening bulls retreat completely.

On the second candle, the security gaps down and sells off to a new low, but buyers seize control and boost the price back to the preceding close, but not above it. According to the bears, the bulls were unable to drive the price above the previous close.

In theory, the pattern is considered a continuation pattern, implying that the price will continue to fall as a result of the pattern. In actuality, this happens just about half of the time. As a result, the pattern frequently implies at least a short-term upward reversal.

By ~ Capital Varsity